Staff Product Designer

Improving the money transfer out flow to prevent mistakes

Introduction

Transferring money should be seamless, secure, and error-free—especially when dealing with essential financial transactions. At Nubank, where we pioneered digital banking in Brazil, our goal has always been to democratize access to banking services while ensuring a frictionless user experience. However, even the most intuitive systems can have gaps that lead to costly mistakes. This case explores how we identified and addressed an issue where users mistakenly transferred money to the wrong recipient and how we designed a solution to prevent this from happening.

Context

The rise of Nubank and PIX in Brazil

Nubank transformed the Brazilian banking system by providing a digital-first approach and making financial services accessible to millions, particularly for the previously underserved Class C and D populations. For many, Nubank was their first-ever bank account, introducing them to a world of digital financial services.

PIX, Brazil’s instant payment system, was a game-changer in this ecosystem. Launched by the Central Bank of Brazil, PIX enables instant, 24/7 transactions with no fees for individuals. Given its speed and simplicity, PIX quickly became the preferred payment method among Nubank users. However, its immediacy also introduced risks—once a transaction was made, it couldn’t be reversed by the bank, leaving users vulnerable to errors when inputting recipient information.

The problem

When instant transfers become costly mistakes

Our Customer Support team reported cases where users had sent PIX transfers to the wrong person. Due to PIX regulations at the time, Nubank could not intervene to reverse these transactions; only the recipient could return the money. While these incidents were not widespread, they had a significant impact—particularly for users in financial situations where every cent mattered. Given our commitment to building a flawless banking experience, we treated even a small number of cases as unacceptable.

When handling financial transactions, our north star was clear: we aimed for zero errors.

Design changes

Designing for peace of mind:

our strategic changes

To understand why these mistakes were happening, we formed hypotheses based on user behavior:

Users were inputting incorrect recipient details, possibly due to distractions or haste.

Users were not carefully verifying the recipient’s name before confirming the transaction.

Our goal was to introduce safeguards without compromising the seamless nature of PIX transfers. The challenge was striking a balance—adding just enough friction to prevent mistakes without making the process cumbersome. To achieve this, we introduced a more context-aware flow that adapted based on whether it was the user’s first time transferring to a recipient.

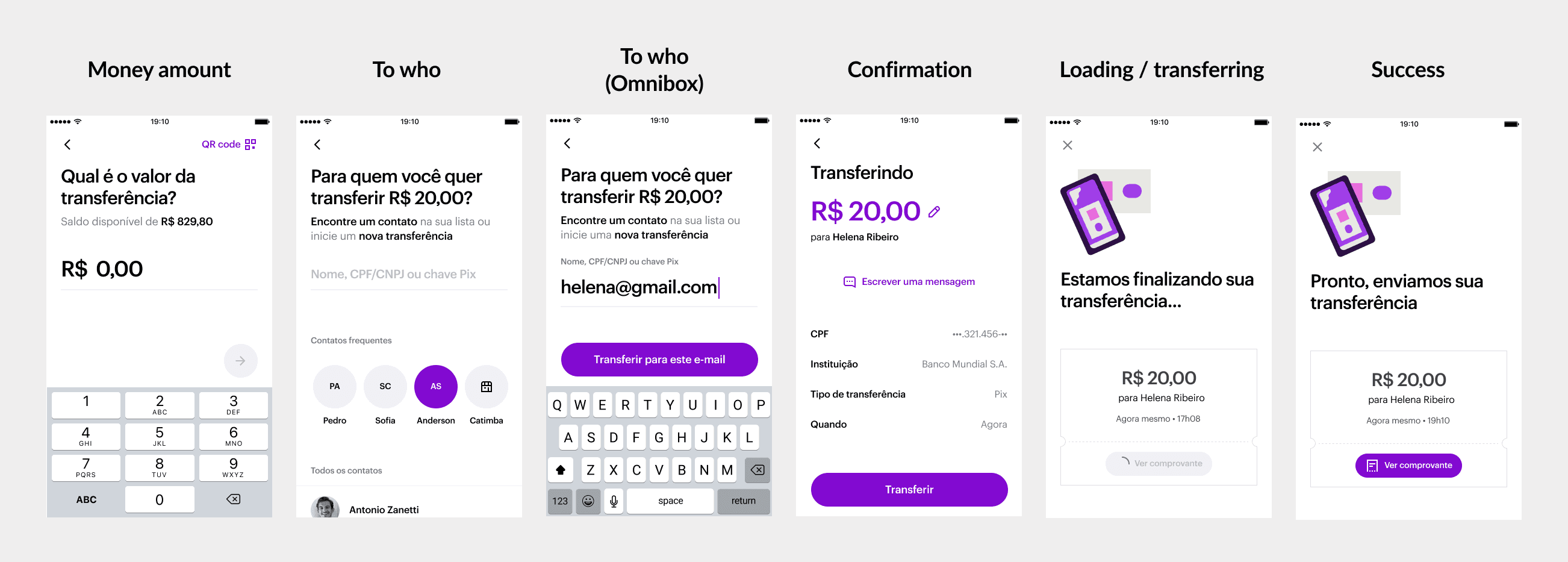

Before flow

The original flow had a straightforward confirmation screen displaying the recipient's name and account details before finalizing the transaction. However, user attention to this information varied, leading to errors.

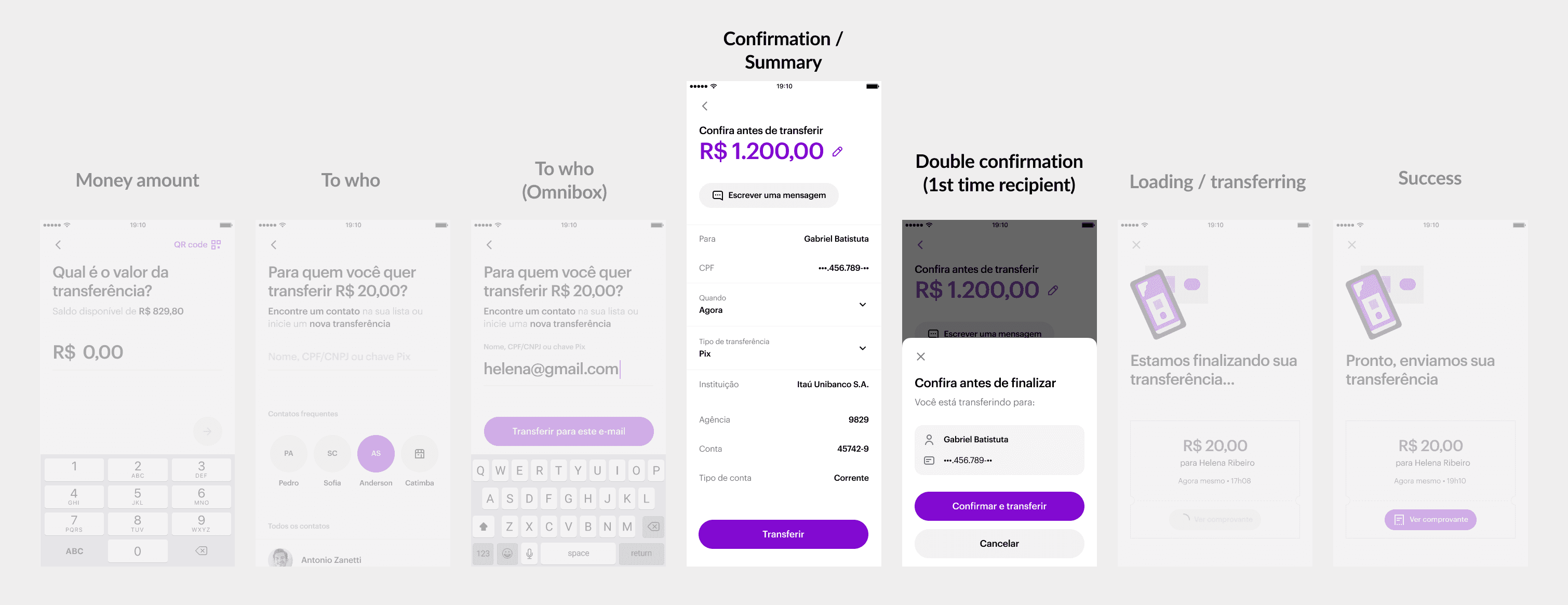

After flow - Key design changes

Dedicated confirmation block: We restructured the hierarchy of the summary screen, creating a specific block that prompts users to review recipient details more attentively. This shift helped highlight the most critical information at the moment of confirmation.

Adaptive confirmation step: Instead of a one-size-fits-all approach, we tailored the flow based on user context. First-time transfers to a recipient triggered an additional confirmation step for added security, while repeat transactions skipped this extra step to maintain a smooth experience.

Progressive rollout & monitoring: As before, we released these changes gradually and collaborated with Customer Support to closely monitor feedback and make adjustments if needed.

Monitoring

Measuring success in the real world

Measuring the success of this solution was complex. Traditional usability tests wouldn’t accurately simulate real-world scenarios, where users handle transactions amidst distractions and daily responsibilities. Instead, we took a multi-pronged approach:

Progressive Rollout: We gradually introduced the new flow to segments of users to monitor behavioral changes.

Customer Support Feedback: We closely tracked reported cases of mistaken transfers to measure improvements.

User Behavior Analysis: We analyzed interaction data to assess whether users were engaging with the additional confirmation step.

Results

What changed: the impact on our customers

The impact was clear: The number of users mistakenly transferring money dropped significantly. For a period following the rollout, we recorded zero reported cases of incorrect transfers from the beginning to the end of the rollout period. To ensure transparency, we monitored this metric over an ongoing basis, continuously validating the impact of our solution. While we acknowledge that human error can never be entirely eliminated, the changes proved highly effective in reducing financial mishaps, reinforcing trust, and improving user confidence in PIX transactions.

By carefully balancing usability with security, we successfully enhanced the PIX transfer experience at Nubank, ensuring users could send money with greater certainty and peace of mind.